We are a Technology Advisory and Capital Enablement firm helping organisations design, deploy and scale technology-led growth strategies. From digital transformation and AI adoption to enterprise platforms and infrastructure, we align technology ambition with capital structuring to deliver sustainable, high-impact outcomes.

Deodotti Limited

We are a strategic consultancy focused on technology and management consulting. We help organisations build future-ready businesses through digital transformation, better operating models and performance improvement.

We ensure technology initiatives are aligned with business strategy, compliant with regulations and designed to scale. We bring practical innovation and strong execution through advisory, transformation support and disciplined programme management.

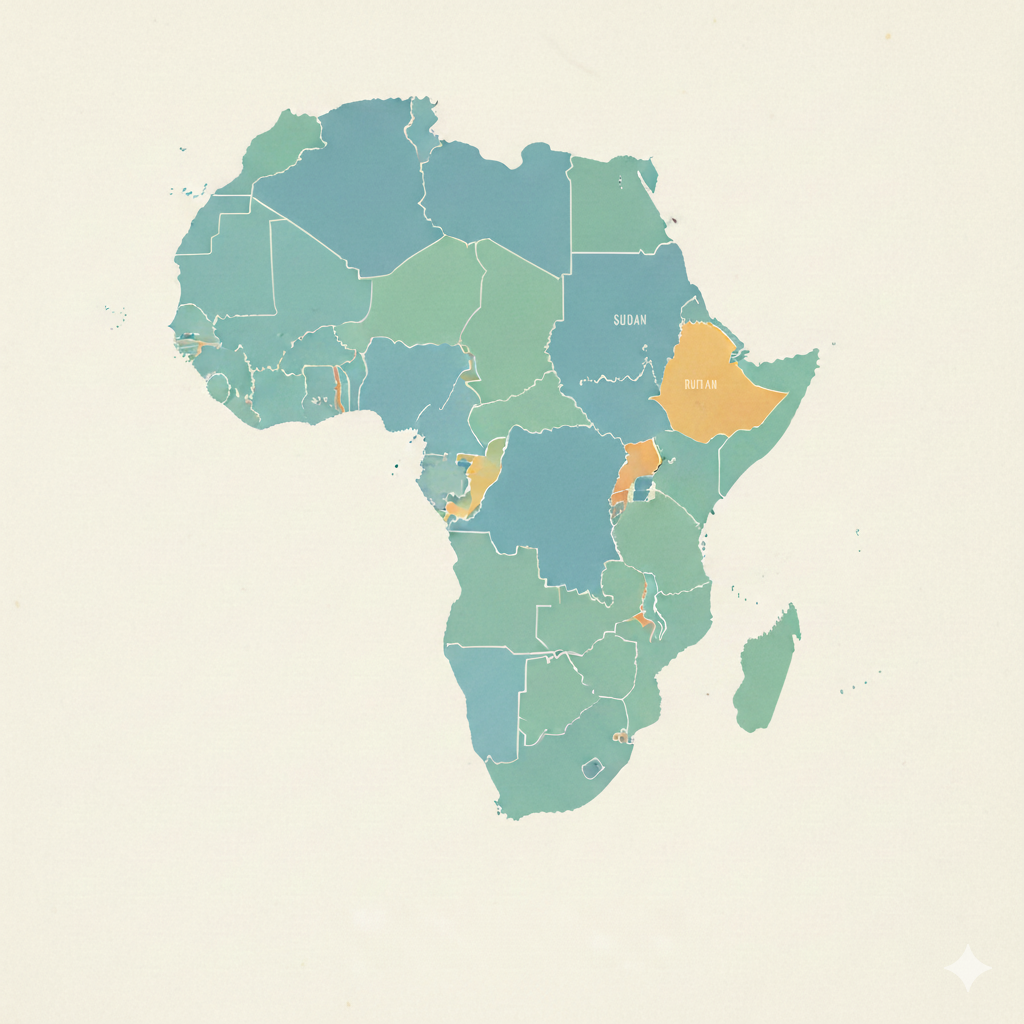

48 Sub-Sahara African Countries Focused

Who We Are

Innovative Technology Consultancy

We provide bespoke technology advisory services that catalyse technology solutions and unlock superior organisational performance. Our consultants bridge the gap between complex infrastructure and strategic vision, delivering rigorous, data-driven insights. Partner with us to architect scalable roadmaps that mitigate risk while positioning your enterprise at the forefront of innovation.

Our origination process emphasises sponsor credibility, asset quality, cash-flow visibility, and regulatory feasibility to ensure transactions are aligned with institutional capital requirements.

Market Entry

We provide market entry services for companies expanding into Sub-Saharan Africa, with Nigeria serving as our anchor market. Our focus is on localisation, regulatory readiness, partnerships and practical execution.

Our approach emphasises market understanding, operational feasibility, customer demand and regulatory alignment to ensure expansion strategies are practical, scalable and sustainable.

Growth Consultancy

We help companies structure growth opportunities so they align with business strategy, operational priorities and performance goals across products, services and market expansion.

We coordinate closely with internal teams and external partners, and manage the flow of information across the entire growth lifecycle to support effective decision-making and execution.

Capital Partner Engagement

We engage capital providers on a mandated basis, with clearly defined transaction scope, exclusivity parameters, and success-based economics. Engagements are structured to support disciplined decision-making, controlled diligence processes, and efficient execution through to financial close.

Our Services

Technology Consultancy

At Deodotti, we drive technology transformation, focusing on stakeholder-centric change management. Our expertise fosters innovation, enhances performance, and ensures your organisation adapts effectively to evolving challenges.

Growth Consultancy

We support organisation with innovative growth strategies and frameworks from “18 Habits” and “5 Pillars of Business Growth” frameworks

Market Entry

Structured engagement with local partners, regulators, distributors and ecosystem stakeholders to support successful market entry and expansion.

This includes coordinating multi-party collaborations, partnership models and phased rollout approaches to enable sustainable entry and scale.

Capital Partner Engagement

Engagement od capital partners for origination of large-ticket commercial transactions across Sub-Saharan Africa, with Nigeria as the anchor market, typically ranging from $50 million

Exclusive Events

Deodotti runs experiential events that blend strategic networking with high-end immersion. Designed for the leaders and exclusive audiences, our bespoke gatherings transcend traditional corporate hospitality, offering sophisticated environments where influential leaders connect, celebrate milestones, and foster transformative partnerships through unforgettable, world-class experiences.

Executive Retreats

Deodotti’s Executive Retreats offer high-level leadership teams complete seclusion in world-class, distraction-free locations. We curate private environments designed for deep strategic focus, ensuring absolute discretion while facilitating the critical thinking and synergy required to navigate complex corporate milestones.

Africa Centric

Deodotti is a technology and business transformation consultancy focused on Sub-Saharan Africa, with Nigeria as its anchor market. We support complex transformation programmes across financial services, energy, infrastructure, telecoms, real estate and other sectors.

Our work typically involves large, multi-stakeholder initiatives, combining strong local execution capability with structured delivery, governance and institutional discipline.

Our Commitment

Excellence in Service

At Deodotti Limited, we strive for excellence in all our services, ensuring high standards and exceptional outcomes for our clients.

Client-Centric Collaboration

We prioritise our clients’ needs, working closely with them to develop solutions that foster long-term success and collaborative growth.

Strategic Catalyst

To be the definitive catalyst for African business success by integrating innovative finance, strategic foresight, and cutting-edge technology. We are dedicated to scaling enterprises through a foundation of uncompromising ethics and integrity, ensuring sustainable growth that transforms the continent’s economic landscape.

Our Team

Dotun Adeoye

Managing Director

Oladitan Olowodola

Channels Director

Donald Lees

Delivery Director

Kingsley Onoyom

Oil & Gas Director

Steve Owbridge

Board Advisor

Musa Ado-Ibrahim

Government Relations Manager

Blessing Ebere Achu

Board Advisor

Akindele Adeniyi

Service Management Director

Dr Asma’u Bello Abubakar

Board Advisor

Seye Oyetade

Board Advisor

David Ezquerro

Technology Advisory Lead

Okechi Awujo

Chief Technology Officer

Lee’Ann Burgess

Board Advisor

Matthew Ogbanje

Finance Director

Femi Omotoso

Legal Risk & Compliance Lead

Adebayo Adekoya

HR Director

Contact Us

- +234 209-700-3060

- [email protected]

- 4th floor, Churchgate Tower, Plot 473 Constitution Ave, Central Business District, Abuja 900211, Federal Capital Territory, Nigeria

Deodotti Limited (c) 2026